Sell at column

reversal! 5900 important level!

Date: 7th October

2013

Price declined earlier during

the week and rallied latter. The reversal or column of ‘X’ was discussed in

last week write up. Given resistance levels are seen on Friday.

But as said, I don’t know

if price will respect this resistance zone or it has something else in store. Let

the column reverse to know the resistance level.

Charts and analysis:

Figure 1 is 10 box chart

plotted with closing prices and 6% bands of 10 day SMA. Price has rejected the

upper band and trading near significant resistance. Figure 2 is chart plotted with high - low

prices and shows anchor point levels in Nifty. Recent high and low box values

are exactly between those anchor point bands. Breakout or rejection needs confirmation

by formation of basic P&F patterns.

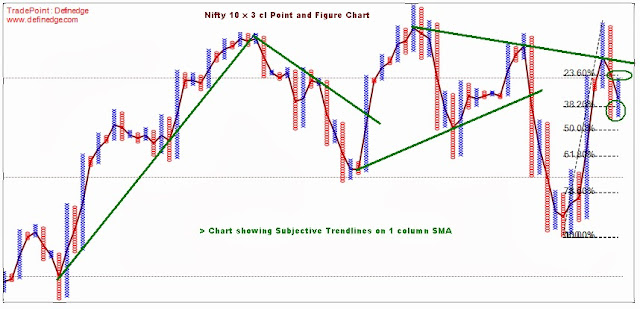

Notice the figure 3. It

displays subjective trend lines on 1 column SMA on 10 box chart plotted with

closing prices. 1 period average is simply a midpoint level of every column.

Such trend line analysis helps in removing the noise and analysing a trend of

column reversal. Chart also shows the Fib retracement levels.

Downside counts are dominating

and trend is down. This downtrend gets negated if price trades above bearish

resistance objective line. A breakout (Double

top buy) signal above 5900 will confirm this breach and negate the downtrend. Hence

the 5900 level on closing basis is important and strategy needs to be formed

around that level.

P&F strategy for next week:

Go short at first formation of ‘O’

from here with stoploss placed at Double top buy signal. This would be a trade

with tight stoploss. Apply aggressive exit (column reversal) if that reversal

is above 5900. Double top buy signal above 5900 is a breakout above bullish

support line hence should be taken.

In simple words, Set up is still

negative but sustenance or breakout above 5900 levels will make downtrend weak.

Breakout in P&F charting is simple Double top buy and Double bottom sell

signal.

| |

|

|

| Figure 2: Nifty 10 x 3 HL Point and Figure Chart |

|

Figure 3: Nifty 10 x 3 CL Point and Figure Chart

|

- Prashant Shah, CMT, CFTe

Disclaimer:

All information provided above is for general

information purposes only and does not constitute any investment advice.

Company or Author shall not be liable for loss or damage that may arise from

use of information provided above. The report is purely for information

purposes and does not construe to be investment recommendation/advice or an

offer or solicitation of an offer to buy/sell any securities. The readers of

this material should take their own professional advice before acting on this

information.

No comments:

Post a Comment