Trade ‘O’ below 6160!!

Date: 18th

November 2013

Nine red candles is a serious

correction. Double bottom sell signal that was discussed in last week post is

formed in Point & Figure charts along with Bull Trap bearish formation.

Chart analysis:

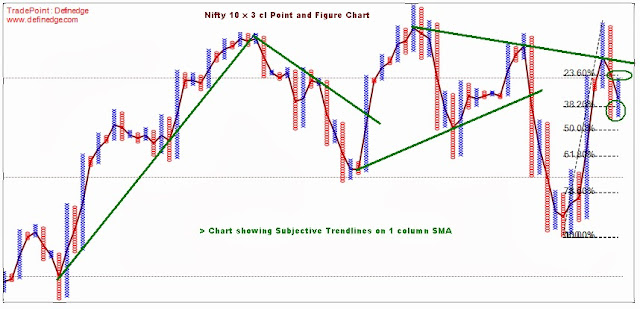

As usual, Figure 1 is 10 box

P&F chart of Nifty plotted with daily closing prices and Figure 2 is same

chart plotted with daily high-low prices.

Too many things are plotted in

Figure 1 but I had to point them all. I discussed about Relative high and High

pole formation in last post. A Bull Trap pattern is also formed along with them that makes picture more bearish. A close below 5990 will open targets of

5670 and more. A Fib level, Anchor point levels and Middle band indicates

supports around 5800. High pole pattern in Figure 2 of High-Low chart is also accompanied

by Bull Trap pattern.

Good to have column of ‘X’ after

such bearish setup because they provide affordable trading opportunities. In

simple words, rallies in bearish mode are good spots to trade short.

The setup has become bearish and signaling

some downside but I am still looking at it as a corrective move to uptrend and would want to trade next double top buy signal because previous trend was up. Such corrective moves form Mini Bottoms during uptrends.

A trade above 6160 will form a

Low pole pattern which is bullish and provide confirmation for Mini Bottom.

Subsequent Double Top Buy signal is a trade to be taken then.

P&F strategy for next week:

Trade Short if column is reversed

to ‘O’ and trading below 6160.

|

| Figure 1: Nifty 10 x 3 CL Point and Figure Chart |

|

| Figure 2: Nifty 10 x 3 HL Point and Figure Chart |

- Prashant Shah, CMT, CFTe

Disclaimer:

All information provided above is for general information purposes only and does not constitute any investment advice. Company or Author shall not be liable for loss or damage that may arise from use of information provided above. The report is purely for information purposes and does not construe to be investment recommendation/advice or an offer or solicitation of an offer to buy/sell any securities. The readers of this material should take their own professional advice before acting on this information.

All information provided above is for general information purposes only and does not constitute any investment advice. Company or Author shall not be liable for loss or damage that may arise from use of information provided above. The report is purely for information purposes and does not construe to be investment recommendation/advice or an offer or solicitation of an offer to buy/sell any securities. The readers of this material should take their own professional advice before acting on this information.