Trend is up. 6110

important level!!

Date: 28th

October 2013

I have been saying that

following price is a much better business and worth enjoying. Column reversal triggered

exit from longs below 6170 during last week. So position is neutral at the moment and trend is

up.

Charts analysis:

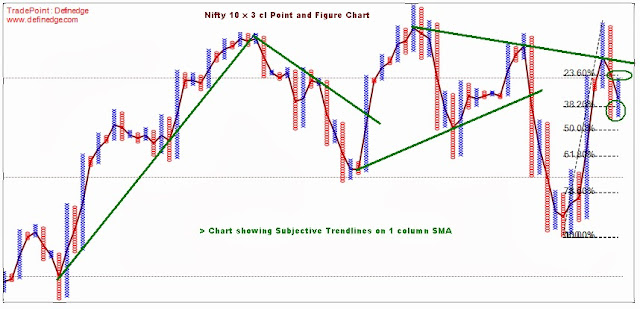

Figure 1: Trend is up and

upper counts are dominating. Triple top breakout has made the setup bullish. So

I am looking for longs. But close below 6120 will form High Pole bearish

formation and longs cannot be taken then unless new high box is made. Hence Fresh

longs are only possible if Nifty closes above 6210. Anchor Point supports are

around 5850.

Figure 2: As can be seen in

the chart, low below 6110 will form Bull trap bearish pattern and it will

trigger opportunity to go short. Prices might come to 5900 in that case. Fresh longs to be taken if high is made above

6260.

P&F strategy for next week:

Hence setup will become quiet bearish below 6110. And subsequent

double bottom sell signal must be taken. Aggressive traders can short at 6110

also with stoploss placed at 50 points (5 boxes).

Fresh long should be taken if price closes above 6210 or high is

made above 6260.

|

Figure 1: Nifty 10 x 3 CL Point and Figure Chart

|

|

Figure 2: Nifty 10 x 3 HL Point and Figure Chart

|

- Prashant Shah, CMT, CFTe

Disclaimer:

All information provided above is for general information purposes only and does not constitute any investment advice. Company or Author shall not be liable for loss or damage that may arise from use of information provided above. The report is purely for information purposes and does not construe to be investment recommendation/advice or an offer or solicitation of an offer to buy/sell any securities. The readers of this material should take their own professional advice before acting on this information.

All information provided above is for general information purposes only and does not constitute any investment advice. Company or Author shall not be liable for loss or damage that may arise from use of information provided above. The report is purely for information purposes and does not construe to be investment recommendation/advice or an offer or solicitation of an offer to buy/sell any securities. The readers of this material should take their own professional advice before acting on this information.