Nifty

P&F Analysis!!

Date: 11th December 2015

Nifty last closing price: 7610.45

Daily chart

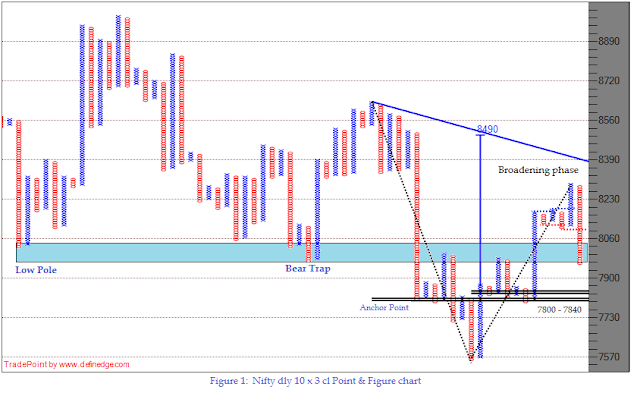

Figure 1 is 10

box P&F chart plotted with daily closing prices. Current formation has got

multiple bearish patterns in the same setup. consecutive bearish broadening

formations, High Pole, Bull trap and Double Bottom sell are formed in the same

column hence overall structure remain bearish. But close above 7690 is exit

level for short trades being a level for Double top buy signal. 7600 is Anchor

point of Nifty when plotted after significant breakout of 6300. Hence it can

remain important reference point for short and medium term traders.

Hourly Min Chart

Figure 2 is 10

box P&F chart plotted with hourly closing prices. Stated earlier that

bearish formation below 7800 will be the first indication that bottom of 7700

may not be held. It quickly made new swing low once 7800 was breached. Prior

low of 7540 is a significant reference point and every trader must be looking

at it. 7680 and 7830 are the reference

levels on the higher side.

Figure 3 is X-Percent

P&F Breadth indicator of Nifty 50. Indicator is at 12% at the moment that

shows that 44 stocks among 50 are in column of 'O' (downtrend) on 1% box value.

It is at oversold zone hence at least some consolidation is expected.

In brief

Trend & momentum is

down but market is in oversold zone. Close above 7690 is an exit level for medium

term short trades. 7540, 7410 are reference levels on the lower side whereas

7680 and 7830 are the key levels on the higher side.

- Prashant Shah, CMT, CFTe

Disclaimer:

All information provided above is for general information purposes only and does not constitute any investment advice. The readers of this material should take their own professional advice before acting on this information.

All information provided above is for general information purposes only and does not constitute any investment advice. The readers of this material should take their own professional advice before acting on this information.